CERMi News

*******

New Publication

The latest article of the CEBRIG :

"Bias in Mission-Driven Finance: Discrimination or Mission Drift?"

Published in the Journal of Business Ethics (Impact Factor: 5.9)

Pub Date: May 18, 2025

DOI: 10.1007/s10551-025-06020-x

Anastasia Cozarenco & Ariane Szafarz

https://link.springer.com/article/10.1007/s10551-025-06020-x

Our 2024 Activity Report is out!

In this edition, you'll find:

An update on our members and seminars held in 2024.

Awards, prizes, and editorial positions held by our members.

Publications by CERMi members in 2024, as well as highlights from conference and much more.

We invite you to explore the report for a comprehensive overview of our activities and accomplishments over the past year.

Exciting Announcement:

Eddy Balemba at ULB for the Master in Microfinance

We are thrilled to announce that Eddy Balemba, Senior Professor in the Faculty of Economics and Management at the Catholic University of Bukavu, South Kivu, DR Congo, will be teaching courses at Université libre de Bruxelles (ULB) from March 26th to June 07th, 2025, as part of the Master’s program in Microfinance 24/25.

Activity Report

Our 2023 Activity Report is out !

What you'll find in this edition :

Update on our members, seminars in 2023...

Awards and prizes and editorial positions of our members...

2023 publications by CERMi members as well as conferences......and more!

Publication

Discover our 18th CERMi Newsletter !

What you'll find in this edition:

Latest and coming events at CERMi (2023-2024)

Awards and prizes (2023-2024)

Recent publications by CERMi members (2023-2024)

June 2024

European Research Conference on Microfinance

CERMi is pleased to announce that the 8th European Research Conference on Microfinance will be held in Bergamo (Italy), on June 24-26, 2024.

June 2024

Public Defense

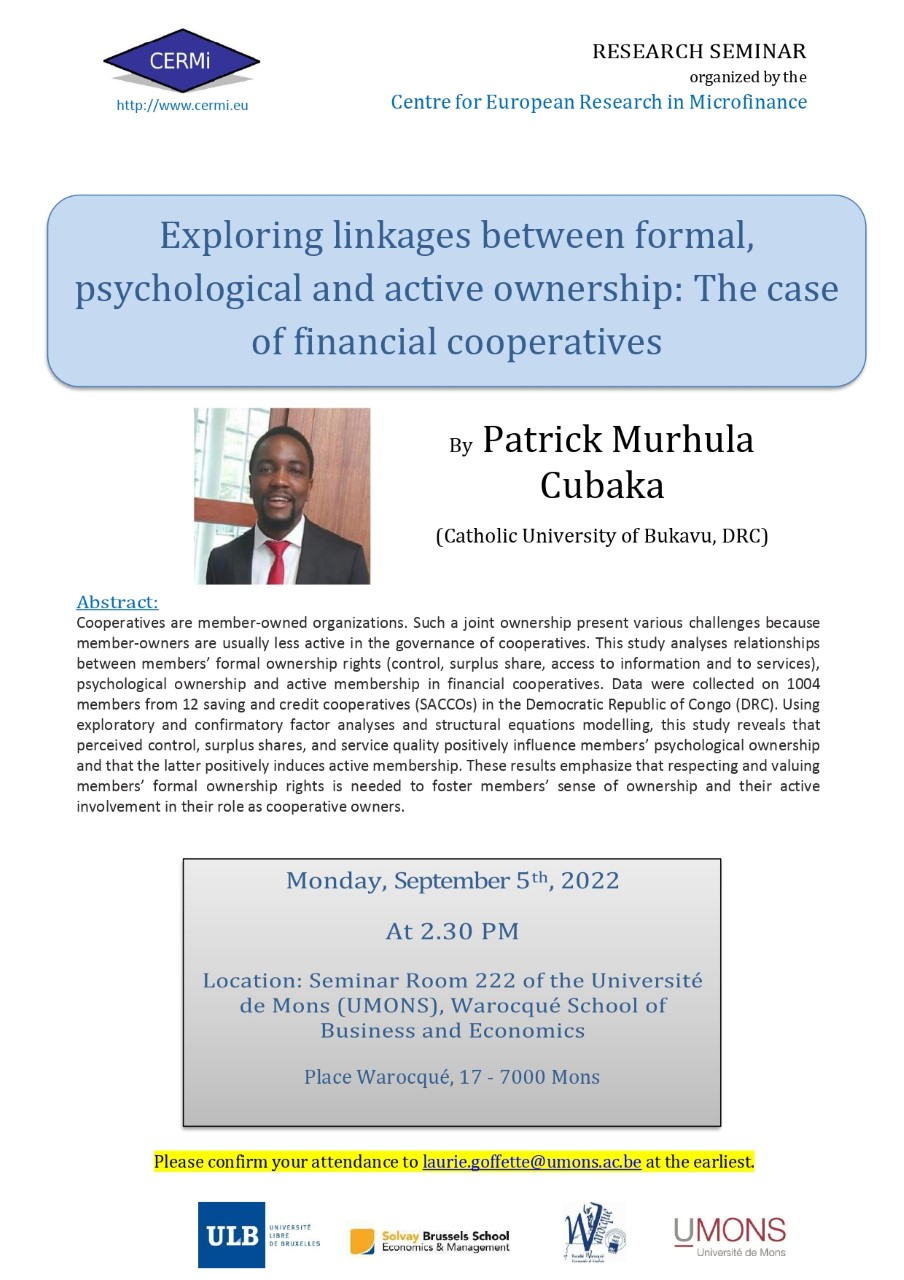

Patrick Murhula Cubaka

Patrick Murhula Cubaka, CERMi PhD student, will publicly defend his PhD thesis “Ownership, Governance and Sustainability of Financial Cooperatives in Microfinance” on June 13, 2024, at 3.00pm at the Université de Mons (UMONS), Warocqué School of Business and Economics. The defense will be held in room Hotyat (first floor).

May 2024

Call For Papers

Elgar Cases in Entrepreneurship Series

Cases on Emerging Market Call for Papers

Case studies in Microfinance and Entrepreneurship: Exploring Frontiers in Poverty, Gender, and Market Dynamics

We are thrilled to announce a call for papers for an upcoming publication titled Case studies in Microfinance and Entrepreneurship: Exploring Frontiers in Poverty, Gender and Market Dynamics, aimed at exploring the intersections of entrepreneurship, microfinance, and socio-economic changes. The collection will enrich the research and educational landscape for scholars, instructors, and students in the field of entrepreneurship. This initiative seeks to assemble a collection of case studies that not only serve as an essential toolkit for researchers and classrooms but also engage students with real-world scenarios that reflect the current state and challenges of entrepreneurship.

Themes and Research Areas:

We invite case contributions that explore innovative and cutting-edge themes within the spheres of microfinance and entrepreneurship, with a special emphasis on:

Emerging Trends in Microfinance:

Innovative models for sustainability, e-commerce ventures, the gig economy and technology’s role in transforming microfinance.

Entrepreneurship at the Margins:

Case studies focusing on how entrepreneurship affects and is affected by marginalised communities, including critical analyses of poverty and gender disparities.

Critique of Neoliberal Approaches:

Examination of market-based strategies, with insights into their implications for entrepreneurs and communities at the grass-root level.

Sustainable and Social Entrepreneurship:

Exploration of business models that balance profitability with social impact, including ventures that challenge traditional approaches and contribute to social and environmental objectives.

Submission Guidelines for Abstracts:

1) Please submit an abstract (approx. 300 words)

2) Abstracts must include information on the study background, focusing on its relevance

to microfinance and entrepreneurship, and clearly state the objectives.

3) It must describe the case and details about methodology, highlighting key insights and

theoretical implications.

Submit your abstract via this link https://forms.office.com/e/vJA60bWA8z

Submission Timeline:

Please submit an abstract outlining your proposed paper/case study, including its relevance to the above themes, by 5th August 2024. Submissions must be made via this MS form in the required format.

A hybrid paper development workshop is planned at the University College Dublin, Ireland for 27th and 28th November 2024.

Full paper submissions (approx. 5,000 words) will be due by 5th August 2025. The full case study should include:

i) Abstract (approx. 100-150 words) and up to 6 keywords, and teaching level

ii) Learning objectives (3-5 bulleted statements)

iii) 3-5 Discussion questions at the end

iv) References and further reading

v) Teaching notes (separate from the case and not more than 1500 words) to guide classroom use of case.

Why Contribute?

Your contribution will be instrumental in shaping a valuable resource that addresses the urgent need for relevant, real-world examples in entrepreneurship education. This book will not only serve as a stand-alone reference but also enrich the digital academic and management resources collection, allowing researchers and instructors to select the most pertinent cases for their work or curriculum.

Contact Information:

For more information or to discuss potential contributions, please contact Rashmi Arora r.arora6@bradford.ac.uk or Supriya Garikipati supriya.garikipati@ucd.ie

April 2024

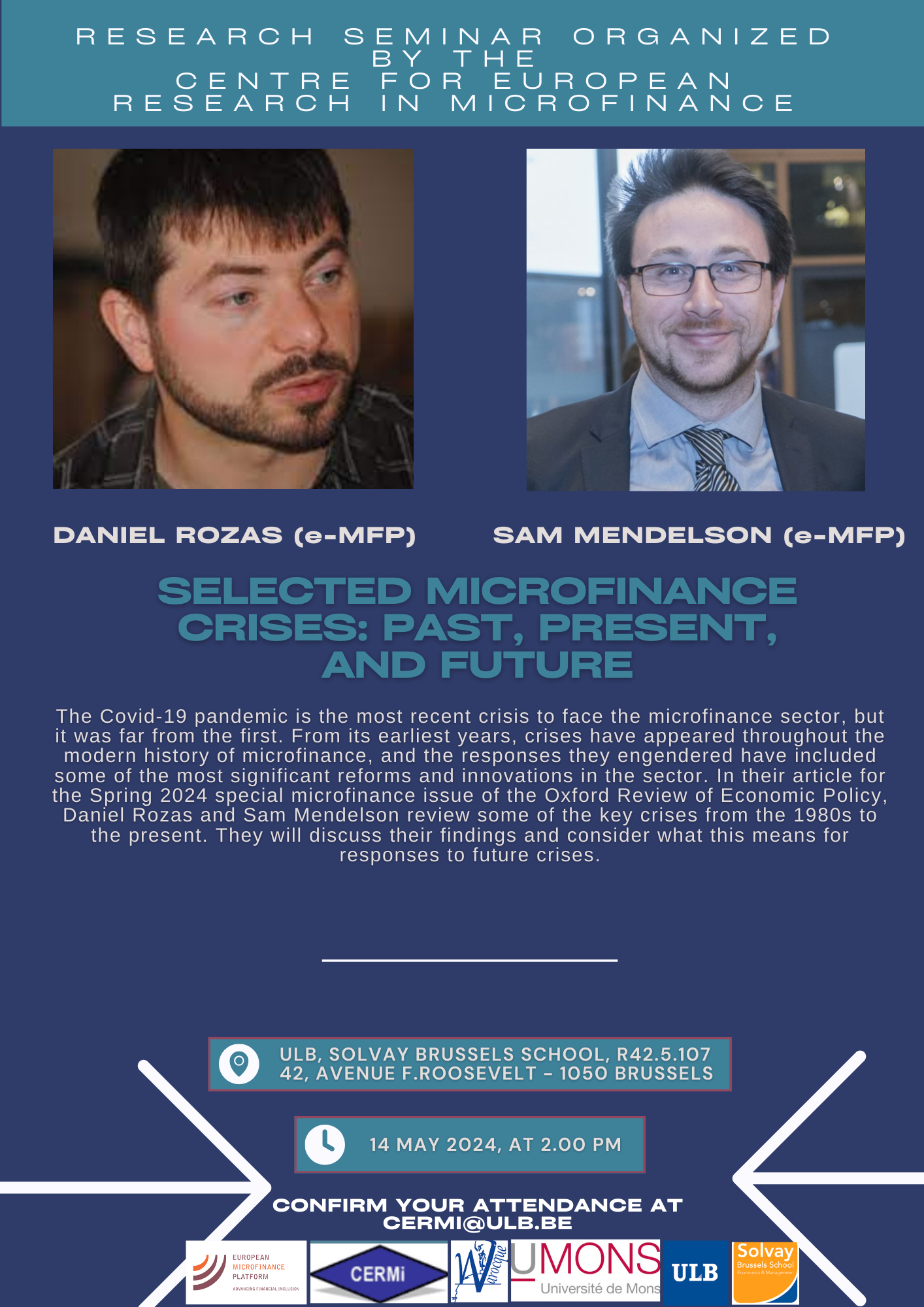

CERMi Seminar

CERMi is pleased to invite you to the seminar "Selected microfinance crises: past, present, and future" that Daniel Rozas (e-MFP) and Sam Mendelson (e-MFP) will be presenting, in English

CERMi is pleased to invite you to the seminar "Selected microfinance crises: past, present, and future" that Daniel Rozas (e-MFP) and Sam Mendelson (e-MFP) will be presenting, in English

Tuesday, May 14, 2024 at 2.00 pm at the Université Libre de Bruxelles (ULB), Solvay Brussels School (R42.5.107 - building R42, level 5, room 107).

Download the poster

March 2024

CERMi Research Day

We are organizing our next CERMi Research Day on March 7, 2024 at the Salle des Conseils of the Warocqué School of Business and Economics (University of Mons), located at 17, Place Warocqué - 7000 Mons, Belgium. During the day, our CERMi researcher, Isabelle Guérin, will present her book “The Indebted Woman - Kinship, Sexuality, and Capitalism”.

Here is the schedule for the day:

- From 10:30am to 5:00pm: CERMi Research Day - access restricted to CERMi members (CERMi will cover the costs of speakers and discussants).

- Later: Dinner.

Guidelines for submitting a paper for the CERMi Research Day:

1) A full paper or extended abstract (2 pages minimum) must be submitted to CERMi (cermi@umons.ac.be) by January 19, 2024,

2) the paper must be submitted by the CERMi member who will present it if accepted (papers with non-CERMi co-authors are allowed),

3) the paper must not be published or accepted at the time of submission to CERMi.

Authors of rejected papers will be given priority as potential discussants.

February 2024

Call for papers

8th European Research Conference on Microfinance

‘Microfinance and Transition: Exploring Pathways for Economic, Social, and Environmental Transformations’

We are pleased to announce that the 8th European Research Conference on Microfinance will take place on 24-26 June 2024 at the University of Bergamo, Italy. The conference is organised by the University of Bergamo in collaboration with the European Microfinance Platform (e-MFP) and the Centre for European Research in Microfinance (CERMi).

Since it was created by CERMi in 2009, the European Research Conference on Microfinance is a special bi-annual opportunity for researchers, students and professionals all over the world to come together in order to share and discuss about their latest advances in microfinance.

The 2024 edition of the conference will delve into the role of microfinance in driving comprehensive transitions across economic, social, and environmental dimensions. Through rigorous research presentations and insightful discussions, the conference participants will investigate the impact of microfinance on economic transformation, exploring its contribution to poverty alleviation, entrepreneurship, and inclusive growth; examine the social implications of microfinance, including its role in promoting financial inclusion, social empowerment, and reducing inequality within communities; and explore the potential of microfinance in fostering environmental sustainability, analysing its support for green initiatives, climate resilience, and sustainable livelihood practices.

During the three days of the conference, researchers from Europe and beyond, including early career researchers, graduate students, and practitioners with interest on academic research will uncover innovative strategies, evidence-based insights, and actionable recommendations to further advance the field of microfinance and transition.

Save the date and join us in-person in Bergamo. Call for abstracts is now open!

Please find all details for submission and further information on the conference at https://www.ercm2024.com/

Deadline for submission: 31st January 2024

January 2024

Call for papers

FINAL REMINDER *** 1 month to submission deadline: 05.02.2024 ! ***

The 3rd ICAFR (International Conference on Alternative Finance Research) will be held in Austria 05-06 June 2024.

The 3rd International Conference for Alternative Finance Research is a dedicated forum for alternative finance researchers and practitioners from all around the globe. It covers themes addressing crowdfunding, digital fundraising and lending, microfinance and prosocial lending, invoice trading, crypto assets and currencies, etc. The conference serves as a cross-disciplinary meeting place for scholars of information systems, economics, finance, entrepreneurship, and marketing under one roof to exchange ideas and help develop the field both theoretically and practically, while engaging in close dialog with industry stakeholders and policy makers.

*** NOTE: Top rated papers by reviewers will be invited for fast-track acceptance for publication with SAGE’s Journal of Alternative Finance ***

The conference is hosted by IMC Krems University of Applied Sciences, and organized by theUiA Crowdfunding Research Center at the Handelshøyskolen ved UiA / School of Business and Law, University of Agder. The event is held in collaboration with the European Centre for Alternative Finance at Utrecht University.

Submission deadline: 05.02.2024

For call for papers see: https://lnkd.in/dGyFApz9

Conference website: https://lnkd.in/d4QzU9kQ

November 2023

Activity Report

What you'll find in this edition : Update on our members, seminars in 2022... Awards and prizes and editorial positions of our members...2022 publications by CERMi members as well as conferences......and more !

October 2023

Call for papers

Special Issue on “Social, Sustainable, and Innovative Financial Services”

Journal of Financial Services Research (JFSR), announces a call for papers for a Special Issue (SI) on “Social, Sustainable and Innovative Financial Services” in partnership with the International Conference in Finance, Banking, and Accounting (ICFBA), held in Montpellier, 8-9 September 2023. JFSR is a highly ranked journal in the field of financial services publishing outstanding empirical and theoretical research.

The financial sector has a key role to play in achieving the UN sustainable development goals by directing capital flows towards social and environmental investment projects through innovative financial services. However, academic research on sustainable finance remains scarce. This special issue aims to fill this gap by bringing together high quality theoretical and empirical contributions. The SI seeks to inform policy makers about the micro- and macro-economic implications of social and green financial services to promote sound public policies.

We are particularly interested in research on Sustainable Financial Institutions (SFIs), also referred to as “alternative,” “ethical,” and “values-based” institutions, which have emerged as a new trend in financial intermediation. SFIs generally combine financial activities with one or more non-financial missions, typically based on environmental and social values. Their market share is growing rapidly and is expected to increase in the future.

Other topics of interest include but are not limited to:

- Environmental, Social, and Governance (ESG) strategies in banking, their costs and benefits

- Cooperative and mutual finance

- Microfinance and financial inclusion

- Climate risk in banking

- Green bonds

- Central bank green finance policies, regulations, and policy initiatives

- Innovative financial services and lending technologies

- Crowdfunding

- Alternative financial institutions

- The role of values and culture in financial decision-making

Authors interested in having their manuscripts considered for this special issue should submit their papers to Anastasia Cozarenco at a.cozarenco@montpellier-bs.com by 15 January 2024. Papers presented at the ICFBA, may be submitted, as well as other papers not presented at the conference. Authors of manuscripts selected for review by the Editorial Board will be invited to submit their papers to JFSR. In addition, selected papers will have a chance to present the progress of their results at a workshop dedicated to this SI, to be held at the University of Zurich on 12 June 2024.

All papers will be peer-reviewed in accordance with the journal's standard policy. JFSR will waive the submission fee for papers submitted to this special issue.

The guest editors of the special issue are:

Renée Adams (Saïd Business School, renee.adams@sbs.ox.ac.uk)

Anastasia Cozarenco (Montpellier Business School, a.cozarenco@montpellier-bs.com)

Steven Ongena (University of Zurich, steven.ongena@bf.uzh.ch)

In collaboration with Haluk Unal (Robert H. Smith School of Business, University of Maryland, unal@umd.edu), Managing Editor of JFSR

August 2023

Publications by different authors

ASHTA Arvind

AUGSBURG Britta

BASTIAENSEN Johan

Bottom-Up Microfinance Plus as an Entry Point for Transformative Empowerment of Women and Climate Change Adaptation in the Smallholder Domain in Chimanimani, Zimbabwe

A Ndabaningi, HM Tirivangasi, J Bastiaensen

The Palgrave handbook of global social problems/Baikady, R.[edit.]; et al., 1-25

BIOSCA Olga

Climate Resilience Through Microfinance: Insights from Rwanda

K Helwig, O Biosca, E Christensen, M Mikulewicz, P Mugiraneza, ...

Glasgow Caledonian University

BULTE Erwin

|

Short-and Medium-term Impacts of Employability Training: Evidence from a Randomised Field Experiment in Rwanda

A Alcid, E Bulte, R Lensink, A Sayinzoga, M Treurniet

Journal of African Economies 32 (3), 296-328

|

|

|

Incentivizing and nudging farmers to spread information: Experimental evidence from Ethiopia

S Balew, E Bulte, Z Abro, M Kassie

American Journal of Agricultural Economics 105 (3), 994-1010

|

|

|

|

The economic impacts of house screening against malaria transmission: Experimental evidence from eastern Zambia

B Chisanga, E Bulte, M Kassie, C Mutero, F Masaninga, OP Sangoro

Social Science & Medicine 321, 115778

|

|

|

Low-quality seeds, labor supply and economic returns: Experimental evidence from Tanzania

E Bulte, S Di Falco, M Kassie, X Vollenweider

The Review of Economics and Statistics, 1-33

|

CABALLERO-MONTES Tristan

COPESTAKE James

COZARENCO Anastasia

Women on Boards and Performance Trade-offs in Social Enterprises: Insights from Microfinance

M Bennouri, A Cozarenco, SA Nyarko

Journal of Business Ethics, 2023• Springer

Methods and Application to Microcredit, 2023• papers.ssrn.com

DALLA PELLEGRINA Lucia

Efficiency and Outreach in the European Microfinance Sector

L Dalla Pellegrina, D Diriker, P Landoni, D Moro

University of Milan Bicocca Department of Economics, Management and …

D'ESPALLIER Bert

GUTIERREZ NIETO Begoña

Assessment of microfinance institutions and their impact: evidence from a scientometric study

Handbook of Microfinance, Financial Inclusion and Development, 2023

• books.google.com

HARTARSKA Valentina

Scope economies from rural and urban microfinance services

V Hartarska, J Zhang, DA Nadolnyak

Southern Economic Journal 89 (4), 1138-1167

Overview of microfinance, financial inclusion, and development

R Cull, V Hartarska

Handbook of microfinance, financial inclusion and development, 2-19

LENSINK Robert

The Origins of Optimism: A Lab-in-the-Field Experiment among Microfinance Clients in Bolivia

F Cecchi, E Voermans, R Lensink

Economic Development and Cultural Change 72 (1), 000-000

Religion, social desirability bias and financial inclusion: Evidence from a list experiment on Islamic (micro-) finance

S Ahmad, R Lensink, A Mueller

Journal of Behavioral and Experimental Finance 38, 100795

Uptake, use, and impact of Islamic savings: Evidence from a field experiment in Pakistan

S Ahmad, R Lensink, A Mueller

Journal of Development Economics 163, 103098

Does microfinance cause banking sector development and economic growth? An application to Mongolia

B Myagmar, R Lensink, W Heijman

Handbook of Microfinance, Financial Inclusion and Development, 425-448

MERSLAND Roy

Does It Pay to be Green? A Study of the Global Microfinance Industry

LA Beisland, S Zamore, R Mersland

Nonprofit and Voluntary Sector Quarterly 52 (3), 631-653

Female leaders and financial inclusion: Evidence from microfinance institutions

RØ Strøm, B D’Espallier, R Mersland

Review of Corporate Finance 3 (1–2), 69-97

Excessive focus on risk? Non?performing loans and efficiency of microfinance institutions

S Zamore, LA Beisland, R Mersland

International Journal of Finance & Economics 28 (2), 1290-1307

NYARKO Samuel?

Women on Boards and Performance Trade-offs in Social Enterprises: Insights from Microfinance

M Bennouri, A Cozarenco, SA Nyarko

Journal of Business Ethics, 1-34

RANDØY Trond

All in the family? The impact of founder directors and family governance on microfinance institutions' social performance

S Hossain, J Galbreath, MM Hasan, T Randøy

Corporate Governance: An International Review

SANDBERG Joakim

Toward a theory of fair interest rates on microcredit: balancing the needs of clients and institutions

M Hudon, J Sandberg

Handbook of Microfinance, Financial Inclusion and Development, 83-98

TCHAKOUTE Hubert

Loan officer gender and loan repayment performance. Evidence from greenfield microfinance institutions in Cameroon1

H Tchakoute Tchuigoua

Annals of Public and Cooperative Economics 94 (2), 519-548

Investigating the unobserved heterogeneity effect on outreach to women: lessons from microfinance institutions

FS Fall, H Tchakoute Tchuigoua, A Vanhems, L Simar

Annals of Operations Research, 1-22

Does corporate social responsibility pay? Evidence from social ratings in microfinance institutions

C Simo, HT Tchuigoua, J Nzongang

Technological Forecasting and Social Change 187, 122180

July 2023

Publication

Frontline Employees’ Job Satisfaction in Microfinance Institutions: Scale Development and Validation.

Eddy Balemba Kanyurhi, Deogratias Bugandwa Mungu Akonkwa, Patrick Murhula Cubaka et Willem Bitakuya MBONEKUBE (2023). Finance Contrôle Stratégie, (26-2).

Studies that measure frontline employee job satisfaction in microfinance institutions (MFIs) are still scarce. The present study fills this gap and develops a measurement scale for MFIs’ frontline employees. Data were collected from 226 and 419 frontline employees from 50 and 53 MFIs in the Democratic Republic of the Congo. These data were processed through exploratory and confirmatory factor analysis and structural equation modelling. The results confirm that employee job satisfaction is a multidimensional construct with 10 factors. The scale was found to be reliable and valid, suggesting that the measure of job satisfaction has to be context and sector specific.

June 2023

Publication

The changing role of banks in the financial system: social versus conventional banks.

By Simon Cornée, Anastasia Cozarenco & Ariane Szafarz (2023).

In Sustainable finance and ESG: Risk, management, regulations, and implications for financial institutions (pp. 1-25). Cham: Springer International Publishing.

Social banks have emerged as a new group of banks that call themselves as “alternative”, “ethical”, “sustainable”, and “value-based”. Their small market share increases at a rapid pace and is still expected to grow in the future. Social banks are institutions with both (at least some) activities of financial intermediation and one or several non-financial missions, typically based on environmental and social values. By unpacking the observable, real-life differences between social banks and conventional banks, this chapter paves the way to theorizing the multidimensional characteristics of social banks within the global banking industry. Business models, governance issues, lending technologies, and social outcomes appear to be key aspects to understand how innovative, value-based, social banks work and how they might one day substantively affect mainstream banking business.

May 2023

Publication

15. Financial inclusion in high-income countries: gender gap or poverty trap?.

By Anastasia Cozarenco & Ariane Szafarz (2023). Escalation Management in International Crises: The United States and its Adversaries, 272.

Little is known about the determinants of financial inclusion in high-income countries. Using the Findex dataset, we focus on two regions: The Euro area and North America. In the Euro area, access to financial services can be challenging for women, while in North America, poor households are particularly underserved. This chapter explores potential explanatory factors for the gender and poverty gaps in these two regions. As expected, the region-wise poverty gaps in financial inclusion are aligned with inequality measures. Yet, the factors connected with gender gaps are less intuitive. Our analysis shows that gender gaps in financial inclusion are related more to gendered labor-market characteristics than to institutional gender discrimination. This evidence suggests a link between financial inclusion and the need for consumption smoothing. We therefore speculate that, in high-income countries, gendered financial exclusion is driven more by demand-side factors than by supply-side ones.

April 2023

Publication

The process of organizational identification in social enterprises: The role of coalitions.

By Cécile Godfroid & Marc Labie (2023). European Management Review.

This paper offers a detailed and systemic representation of the process of organizational identification in social enterprises, and a better understanding of how individuals position themselves in these organizations. We highlight that identification in social enterprises is the result of the interplay between the multiple identities of the individuals who take part in coalitions defending different institutional logics. Identification will depend on whether or not it is easy for the individual to find a coalition that corresponds to him or her, and on whether or not the ideas of this coalition are dominant. The relative size of the various coalitions among the staff and the way they evolve will have a clear impact on what the dominant logic of the social enterprise will be.

March 2023

Publication

Toward a theory of fair interest rates on microcredit: balancing the needs of clients and institutions.

By Marek Hudon & Joachim Sandberg (2023). In Handbook of Microfinance, Financial Inclusion and Development (pp. 83-98). Edward Elgar Publishing.

One of the most salient debates concerning microcredit pertains to the unexpectedly high rates of interest charged on microloans - rates which frequently are deemed usurious by outside parties. Microcredit is supposed to be to the advantage of poor borrowers, but at the same time microfinance institutions face comparably high costs. This chapter seeks to give theoretical input into the debate on fairness in microcredit interest rates. By drawing on both contemporary discussions in the industry as well as abstract philosophical perspectives on fairness, we classify and theorise four conceptions about fairness in interest rates and pinpoint their limitations. We finally argue for a combination of consequentialist and rights-based concerns which seeks to balance the needs of clients and institutions. We also draw out some practical implications of this view for both microfinance institutions and governments.

Tuesday, February 28, 2023

Interview and publication

A dialogue on the future of microfinance and international development, an interview of Jonathan Morduch conducted by Marc Labie

Published in Mondes en développement 2022/3-4 (n° 199-200), p. 419-434

What has been learned over the last fifty years about microfinance shows that being too simplistic can be unconvincing. Financial inclusion policies and practices have a role to play in order to help poor households facing the challenges of daily life. Microfinance is also seen as way to empower women, and to support the development of rural and agricultural communities. Is the impact of microfinance really over-stated? Which role microfinance and financial inclusion have to play in development?

This conversation tries to pinpoint the key issues to keep in mind. Jonathan Morduch (Professor at NYU, ULB Doctor Honoris Causa), one of the most respected academics in the field of microfinance and financial inclusion, is interviewed by Marc Labie, CERMi codirector, to identify the challenges that microfinance and financial inclusion policies must face. From microcredit to financial health, Jonathan Morduch gives us his perception of what the future of this field could be.

Monday, February 06, 2023

Publication

Influence of international ownership on the performance of local social enterprises: Evidence from the global microfinance industry

By Kwame Ohene Djan, Samuel Anokye Nyarko, Roy Mersland, Leif Atle Beisland, Linda Nakato

International ownership positively impacts the social performance of social enterprises at the expense of financial performance. International owners mostly use their resources and controlling rights to improve social performance at the expense of financial performance. Current ownership theories do not address how the multidimensional utility function might affect the governance and financing of a social enterprise. There is a need to develop theories for firms with conflicting objectives.

Thursday, February 02, 2023

Call for Papers

The European Microfinance Network (EMN) has launched the call for papers for the European Microfinance Research Award 2023.

Thanks to the support of the European Investment Fund, EMN offers a EUR 2,000 prize to the winner who’ll be also invited to attend the EMN Annual Conference in Paris (14-16 June 2023).

Topics of interest include, but are not limited to, the following: the role of microfinance to support vulnerable populations (in particular women, migrants and young people) and social entrepreneurs, evidence on the impact of microfinance, the role played by innovative financial technologies in facilitating financial inclusion and (social) entrepreneurship, and the importance and usefulness of non-financial services offered to clients. For this edition, papers exploring the role of green inclusive finance in ensuring a just transition in Europe will be especially valued. Papers eligible for selection should present ongoing or finalised research on issues related to inclusive finance in European countries.

To participate, researchers need to send their abstracts by Thursday, 9th March 2023. All relevant information on how to participate to the Award are available on this dedicated page on the EMN website. See also:

LinkedIn

Twitter

Facebook

Thursday, January 19, 2023

Publication

Handbook of Microfinance, Financial Inclusion and Development

Elgar Handbooks in Development

Edited by Valentina Hartarska, Department of Agricultural Economics and Rural Sociology, and Department of Finance, Auburn University, US and Robert Cull, Development Research Group, The World Bank, US.

This timely Handbook collates a range of evidence from top scholars in the field to help readers understand who microfinance reaches, how it helps, and why clients come back. It offers updated views on important concepts that enable a broader framework for understanding poverty and the corresponding financial needs of poor households.

‘This is an outstanding collection of contributions from some of the most highly-respected researchers in the field of microfinance. It provides an excellent overview of the evidence on the success and limitations of microfinance and addresses important topics such as gender and finance, digital finance, and financial literacy. A must-read for anyone interested in microfinance.’

– Niels Hermes, University of Groningen, the Netherlands

‘An impressive collection of articles on many important aspects of microfinance; written by experts in the field and providing a unique and comprehensive overview of where microfinance stands in the 2020s.’

– Thorsten Beck, European University Institute, Italy

Thursday, November 03, 2022

Publication

The Informal Sector and the Environment

Edited By Ranjula Bali Swain & Uma Kambhampati

The informal economy – broadly defined as economic activity that is not subject to government regulation or taxation – sustains a large part of the world's workforce. It is a diverse, complex and growing area of activity. However, being largely unregulated, its impact on the environment has not been closely scrutinised or analysed.

This edited volume demonstrates that the informal sector is a major source of environmental pollution and a major reason behind the environmental degradation accompanying the expansion of economic activity in developing countries. Environmental regulation and economic incentive policies are difficult to implement in this sector because economic units are unregistered, geographically dispersed and difficult to identify. Moreover, given their limited capital base, they cannot afford to pay pollution fees or install pollution abating equipment. Informal manufacturing units often operate under unscientific and unhealthy conditions, further contributing to polluting the environment. The book emphasizes and examines these challenges, and their solutions, encountered in various sectors of the informal economy, including urban waste pickers, small-scale farmers, informal workers, home-based workers, street vendors, and more. If the informal sector is to "Leave no one behind" (as the Sustainable Development Goals promise) and contribute to "inclusive growth" (an objective of the green economy), then its impact on the economy as well as the environment has to be carefully considered.

This book marks a significant contribution to the literature on both the informal economy and sustainable development, and will be of great interest to readers in economics, geography, politics, environment studies and public policy more broadly.

Friday, October 21, 2022

Publication

Journal of Institutional and Theoretical Economics (JITE)

SIMON CORNEE, MARC JEGERS & ARIANE SZAFARZ

Feasible Institutions of Social Finance: A Taxonomy

This paper unpacks the continuum of social finance institutions (SFIs), ranging from foundations offering pure grants to social banks supplying soft loans. The in-between category includes quasi-foundations granting loans requiring partial repayment. In our model, SFIs maximize their social contribution arising from financing successful social projects, under a budget constraint dictated by their funders. We determine the feasibility of each SFI category. Quasi-foundations appear to be efficient and adapted to low market rates. However, reciprocity from SFI borrowers can elicit a so-called hold-up effect, whereby the SFI charges a high interest rate to its loyal clients.

Tuesday, September 20, 2022

Activity Report

Discover our 2021 Activity Report !  What you'll find in this edition :

What you'll find in this edition : Update on our members, seminars in 2021... Awards and prizes and editorial positions of our members...2021 publications by CERMi members as well as conferences...

...and more !

Thursday, September 1, 2022

CERMi Seminar

CERMi is pleased to invite you to the seminar

Thursday, June 9, 2022

Publication

American Economic Association

MARIE BRIERE, JAMES POTERBA & ARIANE SZAFARZ

Precautionary Liquidity and Retirement Saving

This paper argues that role modeling can explain the impact of boardroom gender diversity on corporate performance. It theorizes that female workers are boosted by female leadership, gain increased motivation, and achieve greater productivity, thereby making their female directors more effective. We test this bottom–up approach to the trickle-down hypothesis on data hand-collected among local cooperatives providing microcredit in Senegal. All the organizations surveyed are similar and small, which allows us to use a homogenous performance metric. All of them outsource their human resource management to the same third party, which mitigates the risk of endogeneity. The data cover over 100,000 triads composed of gender dominance on the board, gender of CEO, and gender of credit officer. A better financial performance is achieved when the triad is gender-uniform—be it male or female—confirming the importance of role modeling and suggesting that the performance of female board members depends on the gender composition of the workforce.

Thursday, May 12, 2022

Publication

Small Business Economics

ANAIS PERILLEUX & ARIANE SZAFARZ

Women in the boardroom: a bottom–up approach to the trickle-down effect

This paper argues that role modeling can explain the impact of boardroom gender diversity on corporate performance. It theorizes that female workers are boosted by female leadership, gain increased motivation, and achieve greater productivity, thereby making their female directors more effective. We test this bottom–up approach to the trickle-down hypothesis on data hand-collected among local cooperatives providing microcredit in Senegal. All the organizations surveyed are similar and small, which allows us to use a homogenous performance metric. All of them outsource their human resource management to the same third party, which mitigates the risk of endogeneity. The data cover over 100,000 triads composed of gender dominance on the board, gender of CEO, and gender of credit officer. A better financial performance is achieved when the triad is gender-uniform—be it male or female—confirming the importance of role modeling and suggesting that the performance of female board members depends on the gender composition of the workforce.

Monday, February 07, 2022

Publication

Discover our 17th CERMi Newsletter !

What you'll find in this edition :

Latest events at CERMi

Awards and prizes

Recent publications by CERMi members

Read all previous news...

Patrick Murhula Cubaka, CERMi PhD student, will publicly defend his PhD thesis “Ownership, Governance and Sustainability of Financial Cooperatives in Microfinance” on June 13, 2024, at 3.00pm at the Université de Mons (UMONS), Warocqué School of Business and Economics. The defense will be held in room Hotyat (first floor).

Patrick Murhula Cubaka, CERMi PhD student, will publicly defend his PhD thesis “Ownership, Governance and Sustainability of Financial Cooperatives in Microfinance” on June 13, 2024, at 3.00pm at the Université de Mons (UMONS), Warocqué School of Business and Economics. The defense will be held in room Hotyat (first floor).

What you'll find in this edition : Update on our members, seminars in 2021... Awards and prizes and editorial positions of our members...2021 publications by CERMi members as well as conferences...

What you'll find in this edition : Update on our members, seminars in 2021... Awards and prizes and editorial positions of our members...2021 publications by CERMi members as well as conferences...